In last month’s blog we discussed the San Francisco Mint in 1854, the creation of gold coins and their values today, and the progression of the gold through 1933, when the U.S. Government required that all gold and silver be returned to the U.S. Treasury. This was a demand by the U.S. Government, not a request, and the penalty for failure was a fine of $10,000 and a prison term of ten years. After two years the U.S. Treasury had the physical possession of all the gold and silver in the United States, had made it illegal for citizens to own gold, and had control of all gold exports out of the Country. The dollar was then backed with 40% gold, and this backing held until 1945, when it was changed to a 25% backing.

Now to continue with our story…

What if our gold reserve actually decreased? Wouldn’t that require us to drop the percentage of gold backing to cover the paper money we had outstanding? How could our Nation’s gold reserve actually decrease? Well, there are two obvious answers. One is theft and the other is the sale of gold to other countries. If the answer was not theft, but sales, then why would we sell our reserves? Therein lies the truth and our losses through sales were staggering.

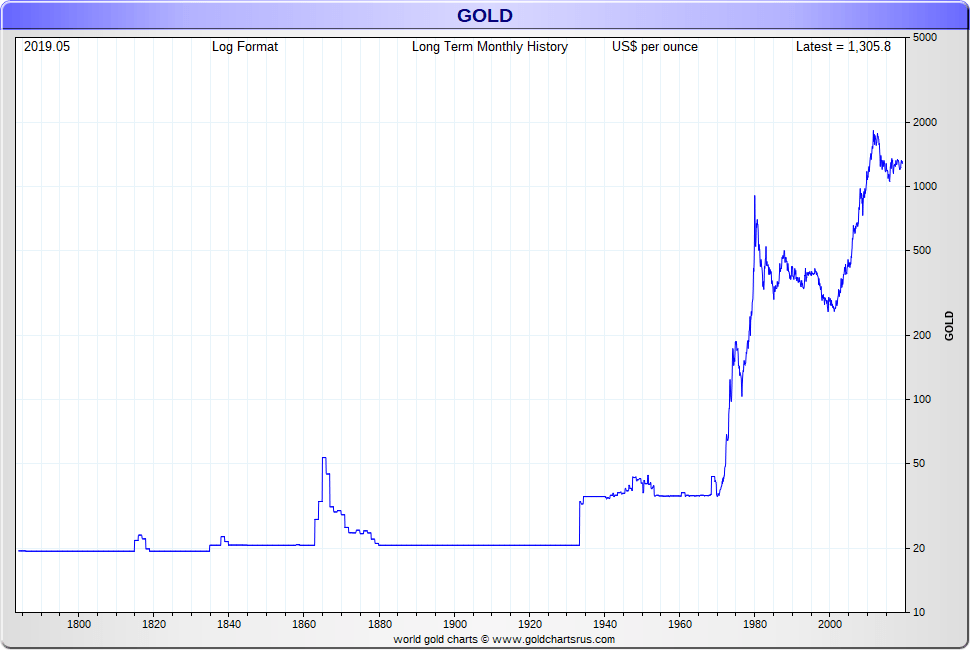

Keep in mind that Roosevelt set the price of gold at $35.00 per ounce in 1934. Even though we were a dominant power in the world, we certainly did not control the price of gold. There was a world market to contend with, and the only way to hold the price at $35.00 per ounce was to buy and sell as needed to maintain the price. For example, if the world market was selling gold at $34.00 per ounce, we continued to buy it until the price rose to $35.00 per ounce. This gave us surplus gold and increased our reserve.

On the other hand, if the World market was willing to pay $40.00 per ounce, we sold our gold until the price dropped to $35.00 per ounce. In this case we lost gold from our reserves.

To make a long story short, the U.S. tried to maintain the $35.00 price by either continuing to sell gold until the price fell to $35.00 per ounce or continued to buy until the price rose to $35.00 per ounce. Our country was playing the commodity market between 1934 and 1971, and we were part of the London Gold Pool plan, of which the U.S. was the leader.

The problem with this approach was that the $35.00 price was too low for stabilizing, so countries bought much more gold than they sold. Others had the wisdom to see further into the future for gold, and Charles DeGaul, of France, who was initially part of the London Gold Pool that was trying to stabilize the prices, withdrew his support and became a vigorous buyer. In 1966 alone, the U.S. lost 571 million in gold reserves, and France gained 601 million.

Then between November 1967 and March 1968, the U.S. lost a staggering 3.2 billion in gold reserves. Sure, we gained paper money, but we couldn’t back the paper with gold that we didn’t have. Many of the other countries were not on the gold standard so the U.S. was staggering with paper and without the gold that was rapidly leaving our country. The end came on March 14, 1968, the day the Gold Pool lost 400 tons of gold to private buyers in foreign countries. In five months, in 1968, the U.S. lost 20% of its entire gold reserve. (That’s why in 1968 the gold backing was removed from the dollar to U.S. citizens and why the gold backing to foreign countries was changed to 18%, from the previous 25%).

Finally, to stem even further losses Richard Nixon issued his proclamation of August 15, 1971, – no further gold trades anywhere in the world for the U.S. dollar. Then in 1974 our freedom was returned to actually own gold again.

Once the U.S. stopped trying to corner the gold market at $35.00 per ounce the value of gold continued to climb, reaching $2000.00 per ounce today.

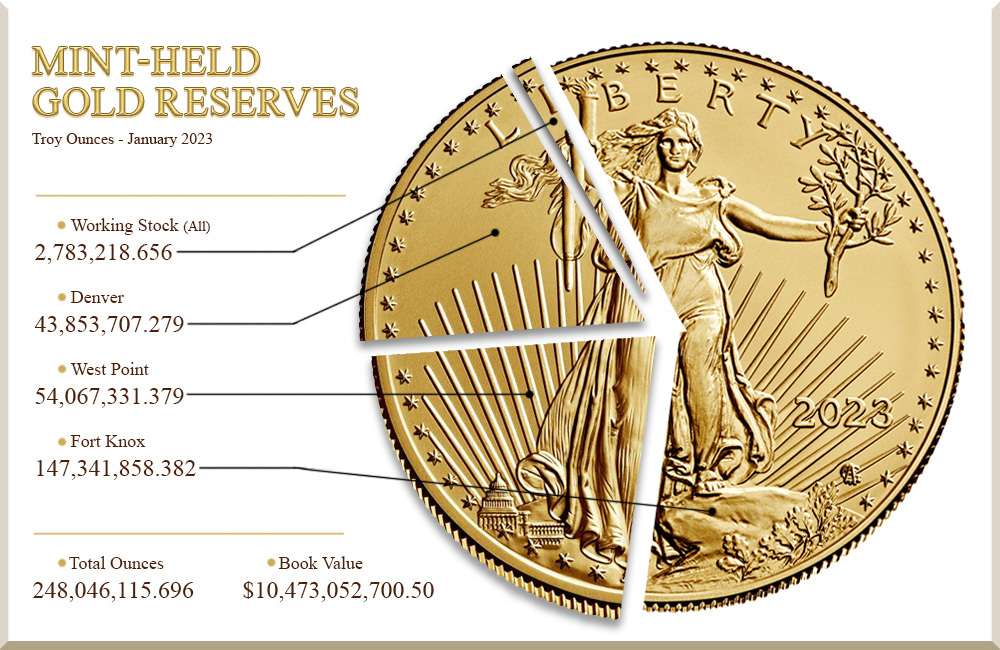

Very few private citizens really understood what was happening because it really didn’t affect them directly. It did indirectly, however. The U.S. lost over 120 million ounces of gold.

So what about our gold coins? Most of them were melted down into bullion and then sold and transferred out of the country. Some are still part of our gold reserves, but not in the form of coins. All this answers one basic question. Why are our gold coins so valuable? Because most of the coins no longer exist, and therefore we have supply/demand criteria, which commands a higher price for the product.

Earlier in the article we talked about reasons for the loss of our gold reserves. Theft was one option and that did occur in the San Francisco Mint in 1854. This was when the Mint first got rolling and the internal controls were obviously not completely worked out.

Mr. Macy was a cashier at the Mint, and he worked out a very simple but effective method of mining without ever leaving the facility. It was Macy’s job to receive the freshly mined coins off the press and to verify the quantity of gold coins inside. In this recorded case of embezzlement, he simply tore off the identifying tag reading $120,000 and then sent a message back to the coiner that he had lost the tag from a $100,000 dollar sack. The coiner, not suspecting any kind of theft, sent him a new tag for the $100,000 quantity that Macy had reported. Logistics became simple. Macy simply removed $20,000 in coins from the $120,000 bag, re-tagged it $100,000, and he just made $20,000 in net profit – and he didn’t even have to lift a pick! Macy managed to leave with a fortune in gold coins before the thefts were discovered.

This theft wasn’t so bad as that accomplished by an assayer who worked on the incoming side of the gold. It was his job to melt down the gold from the miners so that it could then be converted into the stamped coins. The audits showed he kept coming up short and he claimed this shortage was caused by the furnace’s high temperature, causing the gold to partially evaporate and float up the chimney. This was substantiated partially by checking out the inside of the chimney where several thousand dollars of gold dust was found to have been sucked up by the draft. The losses were much more significant that what was found in the chimney, and the assayer finally admitted to high grading his own share of the gold before the smelting process began.

And finally, a janitor, who was considered the best at ridding the Mint of a continual assault by rats, was arrested after finally being caught using his own unique system of making off with gold coins. His method? Once he caught the rat, he would slit them open, insert several gold coins, and then sew the rat back up. No one was at all interested in inspecting the rats as they were disposed of, but the continual shortage of gold coins finally led an industrious Mint inspector to isolate the loss to the janitor, and finally to find his method of stealing the coins!

Well folks, that’s it for now.

Don

Bibliography: The War on Gold, Antony Sutton, “76 Press, 1977; Fabulous Gold, publishers House, Salt Lake City, Utah, 1975; History of Money, Dr. Leroy Brenna, cassette tapes, Texas, 1983. The Forty-Niners, Time-Life Books, New York, 1974.